Growing up, my parents have been super good role models on how to manage money. I’ve always considered myself responsible when it comes to saving and investing, but becoming a mom has given me the biggest reality check when it comes to money.

I thought it would be good for moms to share their thoughts and how they plan for their kids’ futures financially. Money is usually a sensitive topic, but I’m just going to lay it out there because I also want to know—how do you guys invest for your kids?

What We’ve Done So Far

Money in the Bank

This is where I place all of the angpaos (red envelope) my kids receive from birthdays and occasions. Mati and Hannah each have their own savings account. As early as now, we also teach Mati about money. He goes with me to the bank, hands money to the cashier, and his favorite, puts our loose change in the piggy bank.

When they are old enough to grasp the concept of numeracy, they can check their passbook balances and see how they have started saving as babies, and hopefully that will motivate them to save and grow their accounts. The savings account, however, are just a “holding area” for the bigger plan.

Mutual Funds

One of the things I’ve learned about money is that it’s always active, even if we’re not doing anything with it. Leave it in the bank untouched, inflation will slowly eat up your cash’s purchasing power.

When they were a few months old, I enrolled Mati and Hannah to have their own mutual fund account. As they are still minors, it’s an ITF (in trust for) account that I sign and manage. From their individual savings accounts, a fixed amount is deducted monthly from their savings account and placed into a 100% stock/equity mutual fund.

Why 100% equity? In the long run, stock funds beat out bond funds by a mile. When I was in college, I got a 50% equity—50% bond type of fund. I now sort of regret it, since I could compare the huge difference now if I had chosen pure equity fund with hindsight. (I say sort of only, because the consolation was that I started early!)

Admittedly, stock/equity funds are riskier or and more volatile, but I am playing the long game—until my kids reach adulthood at least! We also automate our investments because it’s convenient and it’s disciplined savings—no more excuses. Another benefit is that you also get to “buy” your shares at different prices and average out the highs and lows, rather than placing your bet on just one fixed price.

Critical Illness Insurance

As entrepreneurs, my husband and I aren’t under any employee health plan. If either of us or our kids need medical treatment, we pay for it out of pocket.

In the book I’m reading now, The Thin Green Line, the author quotes one of his billionaire interviewees saying that we’re 5 times more likely to get sick than die at an early age, which is definitely true! Pollution, stress, and all the GMO’s lurking around in our food are a recipe for disease.

I like the concept of critical illness insurance because it pays the insurance benefit upon diagnosis of a critical illness. So it’s a huge burden lifted and one less thing to worry about when dealing with the surprise, pain, and anxiety that comes with a loved one falling ill. Both Albert and I have our own critical illness plans, his benefit amount is double mine since he is the breadwinner. After Mati turned a year old, I got a plan for him too, and the premium was significantly less compared to ours! Insurance premiums favor the young talaga!

Tithing

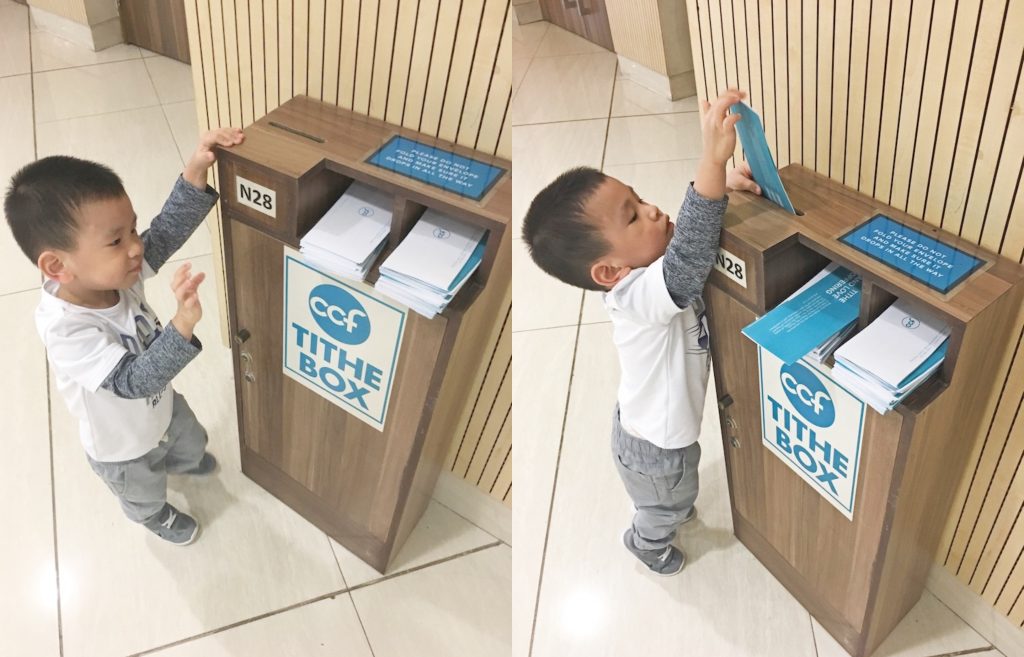

Every time my children receive a cash gift, we also tithe part of it to our church. I fill out the check, and Mati drops it in the tithe box. He may not know or understand yet, but as early as now, I want him to understand that everything comes from God, and we are just stewards. Tithing is one of the ways we check our hearts and invest for eternity.

Extra Money?

Foreign Currency

As some of the angpaos Mati and Hannah receive are in different currencies, eventually if the amount gets big enough, we’d like to invest them on a dollar mutual fund. Thinking on the positive side, we can earn both in terms of the exchange rate and the rate of return of the investment.

Cryptocurrency

I haven’t had the chance yet to research and learn about cryptocurrency (Bitcoin, Ethereum, etc) , but it’s something I’d like to explore with caution. Never invest in something you don’t understand, and at this point, I am unashamed to say that I don’t understand it yet.

Land

Our long term goal for Mati and Hannah is to gift them with land as an inheritance for them. Right now, we’re not yet in the position to do so since we’re in the growing stage of our family.

Two of my in-laws are real estate brokers, and every time we have a family dinner, the topic of real estate is always brought up. The prices just keep getting higher and higher. Truth is, our population will keep on increasing but the amount of available land keeps decreasing.

Bottom Line

I think that as parents, it’s our responsibility to lay out a foundation for our children’s financial future. We don’t need to give them millions upon millions, but enough for them to have a good education and a start in life.

How we model proper financial management today will heavily influence what our children’s attitude towards saving, spending and giving tomorrow.

This article was originally published at: MomYourOwnBusiness.com